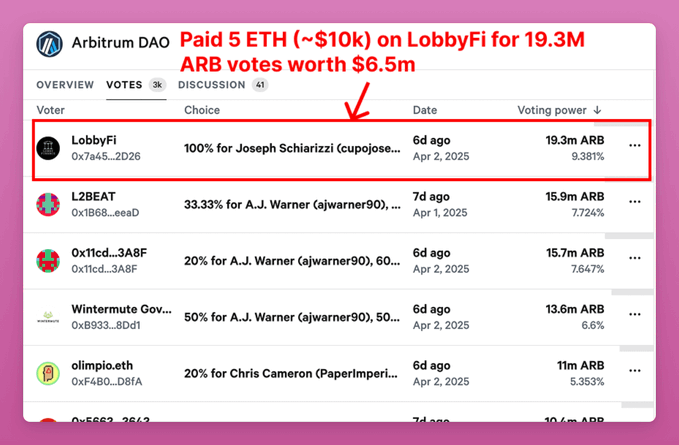

- A vote-buying incident in Arbitrum DAO has exposed serious weaknesses in its governance structure.

- An individual used 5 ETH to acquire over 19 million ARB voting tokens, changing the outcome of a key election.

- The purchased votes surpassed those of major delegates such as L2Beat and Wintermute in influence.

The Arbitrum DAO experiences serious anxiety because someone used 5 ETH to acquire major voting power, thus affecting a crucial committee election outcome. A person bought voting control using 5 ETH to modify the outcome of an essential committee vote. The voting scandal intensifies the need for enhanced digital currency regulation and organizational governance models within DAOs.

Arbitrum Oversight Vote Raises Fairness Concerns

An Arbitrum community member spent 5 ETH to buy voting rights amounting to over 19 million ARB tokens. The voting power acquired by purchasing exceeded the voting strength of L2Beat and Wintermute, along with other well-known delegates. The votes enabled candidates to gain positions as Oversight and Transparency Committee members.

The user leveraged LobbyFi to profit from leasing their token governance rights through this platform. Rapid accumulation occurred regarding voting influence, focusing on the minority population of potential impact areas. Because of this issue, many DAO participants question whether the governance framework provides fair governance or remains resilient.

Oversight personnel earn a monthly payment of $7,500 from their work supervising the DAO, which provides them with financial benefits. According to Crypto regulation advocates, token renting occurs because the incentive system creates opportunities for manipulation. Such electoral practices have a damaging effect on transparency because they tend to weaken governance integrity standards, particularly in votes that aim to protect transparency.

LobbyFi Raises Alarms Over DAO Security

Through LobbyFi, users can obtain revenue from their token possessions by allowing buyers to lease their voting powers. This system allows decentralized organizations to reduce the costs associated with essential decision-making processes, and small participants gain abilities traditionally restricted to large stakeholders.

The Arbitrum case shows how rented votes can be used strategically to secure positions of influence and authority. Many experts predict this situation will heighten the risk of an attack on governance through profit-driven motives instead of upholding community interests. The growing participation in DAOs creates vulnerabilities, which might increase unless government bodies enact specific regulations for the crypto domain.

Security experts urge the development of better protections that should shield decentralized networks against such exposure points. When vote renting remains uncontrolled, it threatens to reduce trust in DAO financial operations and business dealmaking authority. Unprotected DAOs remain exposed to manipulation attempts from coordinated actors.

Compound DAO Faces Backlash Over Treasury Vote

Compound DAO barely endorsed the controversial proposal, which entailed distributing $24 million worth of funds, equivalent to 5%, from their treasury during July 2024. A leading COMP holder directed the protocol to pass a vote, which it initially rejected twice. Many DAO participants described the decision as a misuse of governance powers.

The occasion heightened the concerns about token-based voting when large token holders gain excessive power over decisions. Although the measure succeeded, the controversy demonstrated that selfish profit interests may supersede group-wide interests. Similar to Arbitrum, the situation pointed to gaps in DAO governance.