AAVE, the native cryptocurrency of liquidity protocol Aave, recorded a 4.5% surge during Thursday’s trading session to reach the $185 value. The buying pressure followed a broader market uptick as panic surrounding the U.S. tariffs among investors eased. Amid the renewed recovery, the AAVE’s supply and borrow usage revealed a trend toward broader adoption of the DeFi solution, reinforcing the opportunity of a higher rally.

Key Highlights:

- AAVE price breakout from the wedge pattern signals the end of three months of correction and sets a 30% upswing.

- Aave sees a shift from whale dominance to broader user participation.

- The $225 resistance, backed by the 200-day Exponential Moving Average, creates a high selling point for crypto traders.

AAVE’s Shift Towards Broader Adoption and Growing DeFi Demand

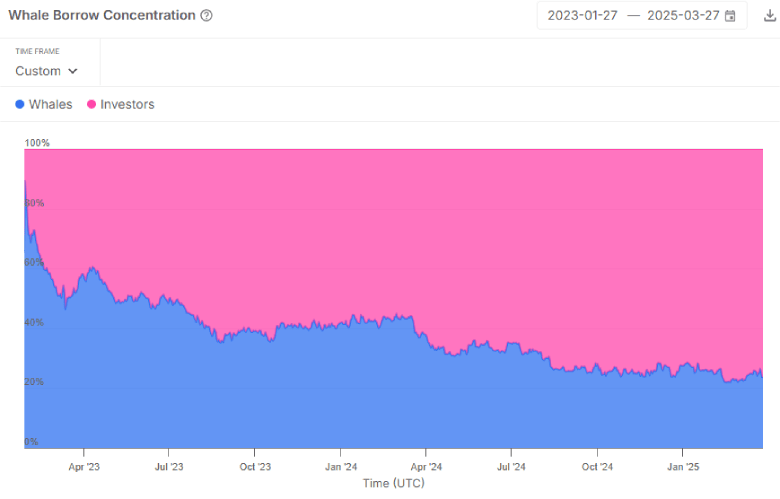

In a recent tweet, Dynamo DeFi highlighted a significant shift in the usage of the Aave’s lending platform. In the past two years, the intotheblock data shows that the concentration of Aave’s supply and borrow usage has dramatically shifted from being dominated by “whales” (large entities) to a more balanced distribution, with whale usage dropping from over 80% to around 20%.

This change suggests a growing democratization of the platform, with an increasing number of everyday users participating in the Aave ecosystem. It also drives a natural demand for its native cryptocurrency as Aave becomes accessible and beneficial not just to large investors, but also to smaller, more average users.

This trend could point towards a broader adoption of DeFi solutions among everyday participants in the blockchain ecosystem.

Also Read: Circle and ICE Explore USDC & USYC for Financial Innovation

AAVE Price Eyes 30% Surge Amid Wedge Pattern Breakout

Over the past two weeks, the AAVE price witnessed a notable upswing from a $160 low to $183, current trading value of $184, accounting for a 15.3% surge. This recovery was further reinforced by a decisive breakout from the resistance trendline of a wedge pattern.

The chart setup, characterized by two converging trendlines, is now commonly observed in several cryptocurrencies amid the current market correction. With today’s intraday surge of +4%, the AAVE coin shows sustainability above the breached resistance trendline, suggesting the potential for further gains.

If bullish momentum persists, the coin price could rally 30% up to challenge $242 resistance, followed by an extended leap to $350.

On the contrary, if sellers pushed the price back inside the wedge pattern, the previous breakout would get invalidated and sellers may strengthen their grip over this asset.

Also Read: Here’s Why Ethereum Price Correction May Bottom At $2,000