AAVE, the native cryptocurrency of leading protocol Aave, witnessed a bullish turnaround of over 11% in the last 48 hours. The buying followed a broad market relief rally as Bitcoin held its ground above $103,000. However, the AAVE price is likely to accelerate this momentum for a multi-month breakout as buyers bolster a traditional reversal pattern amid substantial growth in the future market. Is the $300 breakout close?

AAVE Price Rally Backed By Derivatives Activity

Over the last two months, the AAVE coin has outperformed the majority of major cryptocurrencies, with its price experiencing a substantial surge from $114 to its current value of $265. This 114% upswing pushed the asset above key exponential moving averages (20, 50, 100, and 200), accentuating the positive chase in market dynamics.

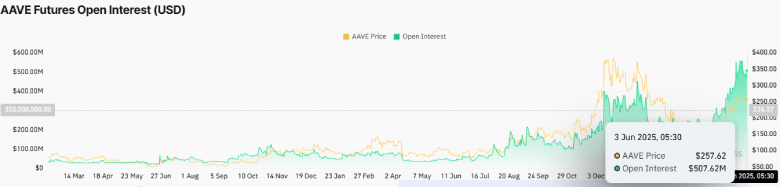

Following the price rally, the AAVE Futures Open Interest has shown a parabolic surge, increasing from $203 million in mid-April to $507 million currently, representing a 150% rise. This rise indicates traders are opening new leveraged positions in the futures market in anticipation of a dynamic. This typically indicates a sustained rally, backed by an increasing number of market participants.

Moreover, the AAVE OI-weighted funding rate also spiked to 0.0078%, indicating that buyers are willing to pay a premium for holding a long position. These elevated funding rates often suggest heightened confidence in the price recovery and market demand pressure.

AAVE Price Pullback Hints Major Breakout

Amid the late May correction, the AAVE price showed a temporary pullback from $282 to $237— a 16% decrease. This reversal, when observed in the daily chart, suggests the potential formation of an inverted head-and-shoulders pattern. The chart setup consists of three troughs: a lower head between two higher shoulders and a neckline connecting the peaks between them.

Historically, the pattern has commonly formed at the bottom for a downtrend, signaling an early signal of recovery. If true, the AAVE price is likely to bounce 6.35% to challenge the neckline resistance at $280.

A potential breakout will accelerate buying pressure and encourage buyers to surpass the downward-sloping resistance that has been active since December 2024. With sustained buying, the post-breakout rally could surge to $378, followed by $400.

On the contrary, the $280 line and downsloping resistance trendline are key resistances against potential. Thus, if sellers continue to defend these levels, the coin could initiate another pullback.

Also Read: Ethereum On-Chain Metrics Signal Weak Sell Zones— Is $3,000 Breakout Imminent?