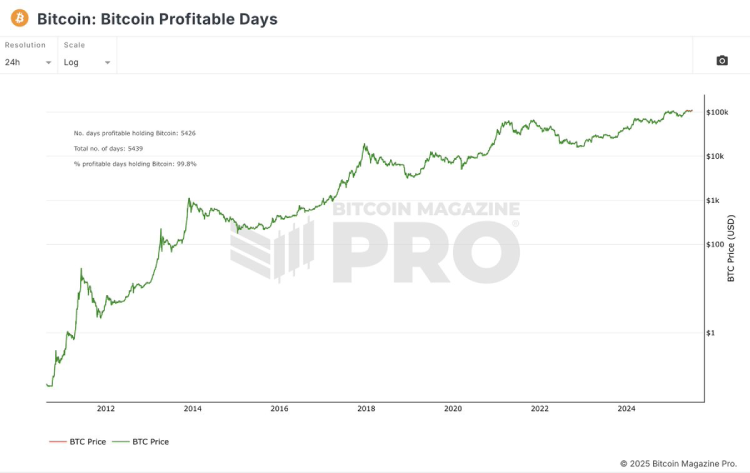

According to Bitcoin Magazine, Bitcoin has been a fruitful investment for nearly everyone who held onto it. In fact, over 99.8% of its trading history, buying and holding Bitcoin would have turned a profit.

(Source: Bitcoin Magazine on X)

In simple terms, this means that for almost every single day since Bitcoin’s creation, long-term holders came out ahead, proving once again that despite wild ups and downs, patience pays off in crypto.

Bitcoin’s Great Institutional Onboarding

Amid growing Bitcoin’s mainstream and institutional adoption, BTC’s value is going through the roof, soaring to approximately $111,891 in 2025. At the time of writing, BTC is trading at around $108,900, according to CoinMarketCap.

Bitcoin miners saw a big boost in profits last month, with earnings climbing 18.2% in May. The surges came as Bitcoin’s price rose 20%, pushing up the value of the coins miners produce.

A steady mining network also helped, meaning miners did not have to compete with a flood of new competitors cutting into their rewards.

Major US-listed mining companies took full advantage of the strong market, pulling in a combined 3,754 BTC during May. Marathon Digital led the pack, mining 950 BTC.

Under the light of clear regulatory guidelines, Bitcoin’s mainstream adoption has grown impressively. Despite short-term volatility, Bitcoin has consistently rewarded long-term holders.

Major price surges (like in 2017,2021, and 2024) have turned early adopters into millionaires, reinforcing the “buy and hold” mindset.

With only 21 million Bitcoins ever to exist, its scarcity drives long-term value. Big players like Strategy, Tesla, MARA, and Wall Street ETFs are now accumulating Bitcoin as a digital gold hedge against inflation. This institutional demand reduces extreme price swings and builds confidence in holding.

Digital Assets Analyst at Standard Chartered, Geoff Kendrick, forecasted Bitcoin will hit a new all-time high (ATH) of $135,000 in Q3, 2025, thanks to strong institutional inflows. He highlighted that Bitcoin ETFs and corporate treasury purchases absorbed 245,000 BTC in Q2 alone, equivalent to nearly a year’s worth of new supply at the currency mining rates.

“Traders on leading prediction markets are placing increasingly bullish bets that bitcoin will achieve record highs by the end of 2025, with overwhelming odds favoring a surge past US$120,000,” the recent report stated.

The analyst notes this cycle breaks historical trends where Bitcoin typically declined 18 months post-halving. “The ETF effect has fundamentally changed market dynamics,” Kendrick stated.

Also Read: There’s Not a Lot Of Bitcoin Left: Fox Business Host