XRP, the cryptocurrency of global payment company Ripple, entered the month of June on a bearish note, recording a 0.73% intraday loss. The selling pressure followed Bitcoin’s breakdown below the $110,000 level. However, the waning traders’ activity in the derivative market signals a sluggish trend ahead. Is XRP below $2 inevitable?

XRP’s Derivative Market Signals Further Correction

The price of XRP in the short term has shown a notable downturn, falling from $2.65 to $2.15, resulting in an 18.6% loss. The downturn plunged the asset below key exponential moving averages (20, 50, and 100), indicating the renewed bearish momentum in the market.

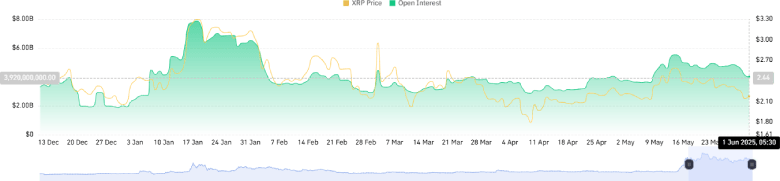

Following the price, the XRP futures open interest fell from $5.52 to $3.99— a 27% decline — in the last three weeks. This decline indicates that traders are closing their open positions in the derivative market, anticipating a sluggish or continued downtrend in this asset.

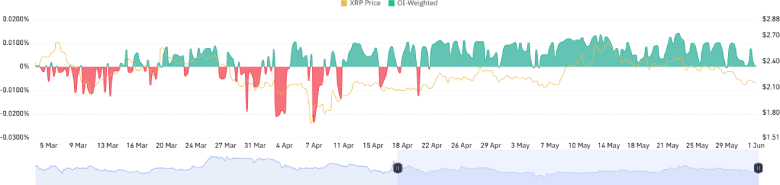

The XRP OI-weighted funding rate at neutral further accentuates the lack of buyer pressure in the market despite the recent pullback. If the trend continues, the coin price will likely continue its downward trend and challenge the $2.08 level.

XRP Price Hints Major Support Breakout

In the daily chart, the XRP price showed its recent correction resonating within two converging trendlines of a pennant pattern. Theoretically, this chart pattern supports a bullish trend, but the recent breakdown below the pattern’s support trend invalidates that thesis and signals the aggressive nature of sellers.

This downswing signals the continuation of a mid-term sideways trend above the $1.77 floor.

However, if Bitcoin remains in its correction trend, the XRP price is likely to break $2.08 support and rechallenge the $1.77 accumulation zone.

On the contrary, the 200-day EMA slope coincides closely with the $2.08 floor, creating strong bullish support. With the decline in OI, the XRP price could consolidate above this support for the coming week before its next move.