Digital asset manager 21Shares has officially filed an application with the US Securities and Exchange Commission (SEC) to launch a Dogecoin spot exchange-traded fund (ETF), joining competitors like Bitwise and Grayscale who have submitted similar proposals.

21Shares Dogecoin ETF Filing

According to Bloomberg analyst James Seyffart, the ETF aims to track the price of Dogecoin, the popular memecoin. Details from the S-1 registration statement filed on April 9th revealed that 21Shares will receive marketing support for the fund from House of Doge, which is an organization affiliated with the Dogecoin Foundation.

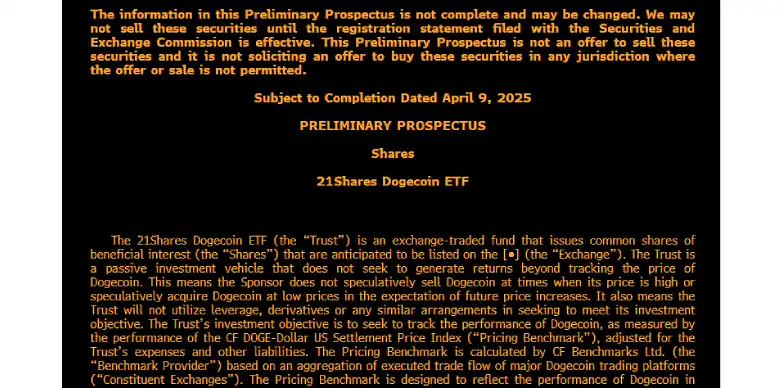

The proposed fund, called the 21Shares Dogecoin ETF (the “Trust”), is created to passively mirror the price of Dogecoin and is expected to be listed on a stock exchange. The Fund will not attempt to outperform the market or engage in speculative trading. The Trust won’t use leverage, derivatives, or other complex strategies. Instead of that, the ETF’s objective is to closely follow Dogecoin’s price trends, as reflected by the CF DOGE-Dollar US Settlement Price Index, after accounting for fees and expenses.

This benchmark index, managed by CF Benchmarks Ltd., aggregates trading data from leading Dogecoin exchanges to provide a reliable snapshot of Dogecoin’s market value.

Expressing his optimism for Dogecoin ETF filing, 21Shares President Duncan Moir commented, “Dogecoin has grown beyond being just a cryptocurrency—it now represents a cultural and financial movement. DOGE gives investors a regulated way to participate in this exciting development.”

Also Read: Teucrium Investment Officially Launches Leveraged XRP ETF Today