The cryptocurrency industry has witnessed a major transformation in recent times, with stablecoins emerging as a dominant player, especially after the US’s key regulatory moves. Amidst this backdrop, Plasma, a Layer1 EVM-compatible stablecoin-focused blockchain, launched its mainnet yesterday, sparking widespread attention.

Adding momentum to the initial buzz, the Plasma blockchain has catapulted to the forefront of the digital asset landscape with a significant $1 billion in stablecoin inflows. This remarkable achievement not only underscores the growing demand for efficient, cost-effective, and reliable stablecoin payments but also highlights Plasma’s innovative approach to revolutionizing the way we think about money movement on the blockchain.

With over $2 billion in total value locked (TVL) at launch and a growing ecosystem of DeFi partners, the network’s momentum is undeniable. The network’s XPL token has also gained significant traction, marking a notable uptrend since its launch. But will this positive momentum sustain?

Plasma Records $1B in Stablecoin Inflow

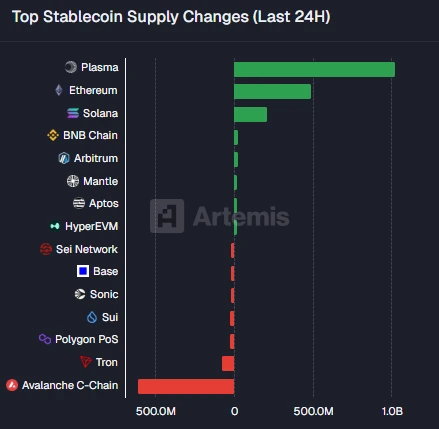

In a recent X post, Rand, a prominent crypto voice on X, has shared insights on the massive growth of the Plasma network, especially in terms of stablecoin inflows. According to Artemis data, Plasma token records the top-most position in stablecoin inflow, with $1 billion flows, overpowering Ethereum.

In addition, over the past seven days, Plasma token has recorded a staggering $2 billion in stablecoin inflows, ranking 2nd on the list below Ethereum. This substantial influx of stablecoins onto the Plasma network underscores the growing demand for efficient and cost-effective stablecoin transactions, further solidifying the blockchain’s position as a leading player in the crypto space.

Plasma Mainnet Launch Details

The L1 Plasma blockchain officially launched its mainnet and native token, XPL, on September 25. The platform boasts zero-fee USDT transfers, thanks to its custom PlasmaBFT consensus mechanism, and features over 100 DeFi integrations. Built as an EVM-compatible chain, Plasma enables users to send USDT without incurring fees during its initial rollout.

Notably, the launch is backed by prominent industry players like Aave, Ethena, Fluid, and Euler. The XPL token is listed on top exchanges, including Binance, Bitfinex, and Tether. As reported, the blockchain debuted with over $2 billion in stablecoin total value locked, which has now surged to $2.549 billion, according to DefiLlama data. Now, Plasma has entered the top 1p blockchain by stablecoin liquidity.

XPL Token Sees Massive Gains

Aligning with the bullish sentiment surrounding the Plasma blockchain, its XPL token is also on a positive track. Following its debut, XPL took a deeper dive only to surge within the blink of an eye. Despite fluctuations, the XPL token is currently exhibiting a positive sentiment, sparking widespread optimism.

Earlier today, the cryptocurrency hit an all-time high of $$1.42 but soon plummeted. Later, the token rebounded to reach $1.35, marking a 65% uptick. At the press time, the crypto is trading at $1.13, up by 9.11% in a day. Since its launch, it has seen a remarkable 36% hike. Although the crypto has experienced significant volatility over the last 24 hours, traders are showing increased optimism towards its potential bull run. This is significantly evident in the massive 12628% surge in its trading volume, currently at $7.4 billion. Boasting a market cap of $2.04 billion, XPL is ranked 49th on CoinMarketCap.